![]()

DNV & Co. is a Chartered Accountants' firm providing consultancy to various foreign companies to seamlessly establish their business entities in India. We advice them on Foreign Direct Investment (FDI) Policy, Foreign Exchange Management Act (FEMA), International tax implications including effect of bilateral treaties and overall entry strategy depending up on their business sector, current business with Indian companies and their reason for setting up Indian arm. We also specialise in Transfer Pricing regulations, Business valuations and secretarial compliance that specifically impacts the such companies.

Over the past few years India has emerged as one of the fastest developing country and has witnessed upsurge in the economic activities on the back of significant influx of foreign investments coupled with technological collaborations.

India Real Estate and Construction

Over the past few years India has emerged as one of the fastest developing country and has witnessed upsurge in the economic activities on the back of significant influx of foreign investments coupled with technological collaborations. This increased cross border transactions have thrown open various challenges on the taxation front in India for such foreign entities.

Principally, if a Company is incorporated in India, its income is taxable in India. India has right to tax global income of this Company based on the principal of "Residential base" of taxation. India also has a right to tax the income of the foreign company to the extent to which the source of income is situated in India. As per the Indian Income Tax Act (The Act), if any income of a foreign company is received or deemed to be received in India OR is accrued/arised or deemed to have accrued/arised in India, the source of such income is said to be in India and by virtue of principal of "source base" of taxation, India has right to tax such income. There are only certain categories of income like Royalties, Fees for technical services, interest, dividend etc. that are covered by this section. Such taxation is generally at a reduced rate of tax and on gross receipt of the foreign company.

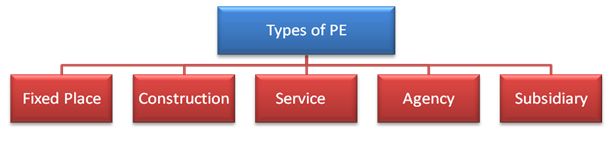

If the foreign Company has extended period of presence in India for carrying out their business activity in India, the income derived by such foreign Company to the extent it is attributable to their presence in India will become taxable in India. From this logic, the concept of Permanent Establishment (PE) is derived. Article 5 on Double Tax Avoidance Agreements (DTAA) that India has signed with various countries thus defines the term PE as "A Fixed place of business through which the business of an enterprise is wholly or partly carried on." There can be following types of PEs:

Fixed Place PE:A fixed place PE of a foreign enterprise exists in the India (source country) when the following tests are satisfied:

Specific inclusions in the definition of PE in Article 5(2) of treaties:

In case of a construction or installation projects, taxable event will arise in India only when the activities of a foreign enterprise constitute a "construction PE" in India. A Construction PE exists when the construction site or an installation project is carried out for a period more than the prescribed period under the respective Tax Treaty with that country.

Different kinds of Construction PE are formed under following activities:

It is seen in most of the treaties that if any of the above activities are carried out in India for a period of more than 6 months or if the charge payable for the project or supervisory activity exceed 10% of the sale price of machinery and equipment, the same is regarded as Construction PE. The duration of the project and percentage of payment towards supervisory activity will vary from Treaty to Treaty with various countries.

It has been 'bone of contention' between assessees and tax officers whether for the purpose of calculation of the duration of contractors' activities in India, time spent on pre-commencement activities like mere planning and supervisory activities (without construction) by the foreign enterprise should be included or not.

Many times, a contract has been awarded to a foreign enterprise who sub-contracts a part of the job to a local Indian sub-contractor. Issue arises that while computing the project duration, is the time spent by sub-contractors on the site/project should be counted for the purpose of calculating presence of foreign enterprise in India. Prof. Vogel has expressed his opinion on this issue as the period spent by a sub-contractor working on the building site must be considered as being time spent by the general contractor on the building project. Though there are conflicting court decisions in India and it will depend on the facts of each case and the wordings of the specific treaty.

Many Indian Treaties provide for existence of Service PE if the foreign Enterprise renders services (Other than Fees for Technical Services) in India through employees or other personnel, if the duration of such services in India exceeds a threshold limit. Generally, the Indian treaties provide for a threshold limit of 90 to 120 days if the services are rendered to unrelated enterprises and 1 to 30 days if such services are rendered to associated enterprise.

If a person resident in India represents or acts on behalf of the foreign enterprise, his presence in India may be regarded as presence of foreign enterprise in India and could trigger establishment of a PE in India of that foreign enterprise. The circumstances which lead to creation of DAPE of the foreign enterprise in India are when ALL the following conditions are satisfied:

If an Indian person acts on behalf of any foreign enterprise and satisfies all of the above conditions, the foreign enterprise will be regarded as having a PE in India.

However, an agent will not constitute a DAPE of its principal if he is an "agent of an Independent status". Following factors will determine the independency of such agent:

Determination of independence is a factual exercise and all the facts and circumstances must be taken into account before concluding whether he is an agent of independent agent.

Mere existence of a subsidiary Company in India does not by itself make the subsidiary Company a PE of the parent Company. To constitute subsidiary a PE, the business of the parent Company should be carried on through the subsidiary Company as understood under the other PE clauses.

Most of the Indian Treaties provide for activities that are specifically excluded from the purview of PE. In such cases, they are not regarded as PE even if any of those activities are carried out through a fixed place of business. These activities are:

Whether an activity in India can be considered as preparative or auxiliary will depend up on the facts and circumstances of each case. Generally, if an activity of the fixed place of business forms an integral and significant part of the activity of the foreign enterprise as a whole or is identical with the main purpose and object of the parent enterprise, such activities will not be regarded as preparative or auxiliary in character. Even if a part of the activities performed in India directly contributes to the earning of revenue, the activities cannot be treated as preparatory or auxiliary in nature. Activities of Liaison Office in India which generally acts as a communication link between the foreign Company and vendors or customers in India is that of preparatory and auxiliary and therefore a Liaison Office, in normal case, is not considered to be a PE in India.

Once it is established that foreign enterprise has a PE in India, the profits that are attributed to its activities in India will be taxed as "Business Income" in accordance with the rules laid down in Article 7 of Treaties. Profits attributable to a PE are those which the PE would have made, had it been dealing independently in the same or similar activities under the same or similar conditions with the other part of the enterprise. Though no guidelines are available to determine how much should be the income reasonably attributable to the operations carried out in India, the same has to be determined on factual situation prevailing in each case. The analysis of attributing profits to the PE has to be undertaken taking into account the Functions performed, Assets utilised and Risks assumed (FAR analysis) by the PE in India. Transfer Pricing regulations have laid down the principals and methods to determine the profits that may be attributed to the activities of PE in India.

Delhi Tribunal in the case of Galileo International Inc observed that though no guidelines are available as to how much should be the income reasonably attributable to the operations carried out in India; the same has to be determined on the factual situation prevailing in each case. To determine such attribution, one has to look into the factors like functions performed, assets used and risk undertaken.

While determining the profits of a PE, expenses that are incurred for the purpose of business of the PE whether incurred in India or outside shall be allowed as tax deductible expenses. The Net Profits then shall be subject to tax that is applicable to a foreign Company in India.

Overall, the PE is one of the most crucial concepts that need to be understood in International Tax regime. Considering the broad review of above understanding, various judicial pronouncements and regulatory provisions, one would have to minutely study and analyse the relevant contracts/agreements and all the relevant facts of the matter and apply appropriate legal proposition in any given case.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.